Store Closures Accelerate Across U.S. Retail Giants

Store closures are hitting American malls and shopping centers hard in 2025. Retail icons once seen as untouchable—Macy’s, Big Lots, Walgreens, and even Starbucks—are shutting hundreds of locations. It’s not just a few shops here and there. We’re talking entire regions losing familiar brands as companies face down a mix of online shopping growth, lean consumer spending, and sky-high operating costs.

For Macy’s, this wave of closures is part of what they call the “Bold New Chapter.” CEO Tony Spring says they’re zeroing in on their most profitable stores, not just clinging to tradition. That’s led to the planned closure of 150 Macy’s stores—50 by the end of 2024, with the rest before 2026 wraps up. By then, their physical footprint shrinks to 350 locations. The logic? Fewer stores mean more focused resources, better merchandise, and improved in-person experiences where it's working. They're not just giving up; they’re shifting the retail game board to survive and compete.

Big Lots is also taking a scalpel to its store count, closing hundreds of outlets amid brutal economic headwinds. Management has made it clear: the traditional discount store model isn't covering costs like it once did. Instead of burning cash, they’re making tough calls—all in the hope of returning to profitability in a rapidly changing marketplace.

Kohl’s, like many of its peers, is tightening its belt as well. The retailer entered 2025 with more than 1,150 stores, but isn’t sharing exactly how many are closing. What’s clear, though, is that the once-blanket presence of department stores is thinning out in small towns and suburbs across the country.

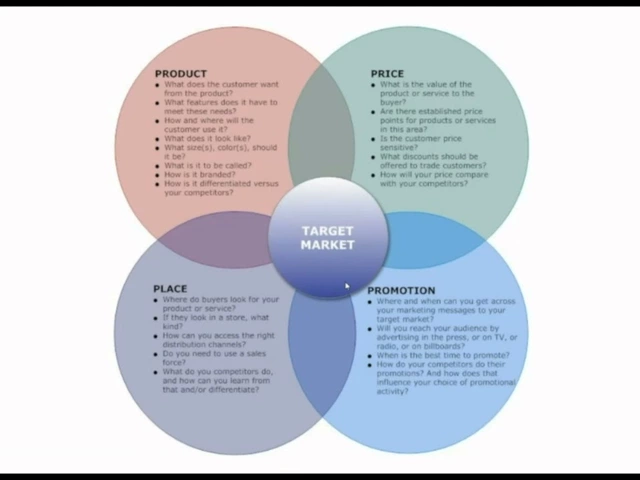

Changing Shopping Habits and the Rise of E-Commerce

As for electronics, Best Buy plans to shutter up to 15 stores in 2025. Their new playbook? Go all in on digital. Physical shops aren’t pulling their weight, especially with so much of their business now online. They see more value in investing in their website and delivery than in paying rent for empty aisles.

Pharmacy chains aren’t immune either. Walgreens, struggling with high labor and operating costs, is slashing hundreds of locations as part of a broader plan to close over 1,000 stores within three years.

Coffee giant Starbucks has also felt the pain, closing 11 underperforming locations by January 2025 and halting expansion in several areas as foot traffic slumps. The places you used to lounge with a latte are becoming harder to find in some neighborhoods.

Retailers like Forever 21, JoAnn, and Party City aren’t just trimming locations—they’ve walked away from U.S. operations altogether. Once-busy mall mainstays are now fading into memory, their stores vanishing as leases expire and merchandise is liquidated.

What’s driving all this? After the pandemic, shopping didn’t return to normal. People got comfortable with curbside pickups, home delivery, and scrolling for deals on their phones. High inflation means shoppers are thinking harder about every purchase, and online competitors can often cut prices lower than any physical store can afford. For many big brands, the answer is sharp, tough, but necessary: fewer stores, leaner operations, and a bigger bet than ever on the power of e-commerce.