KEY POINTS

- Frozen private capital has led U.S. civil and military agencies to step up or accelerate funding to space companies during the coronavirus crisis.

- “We kicked into high gear as soon as it was apparent a lot of companies were not going to be able to conduct business as usual due to distancing requirements,” NASA’s Mike Read told CNBC.

- Brigadier General Steven Butow, leader of the Defense Innovation Unit’s space portfolio, told CNBC his unit is looking to help space companies survive the crisis.

Investment in the fast-growing space industry was booming well into the first quarter of 2020 but private capital has largely frozen as the coronavirus pandemic strikes the U.S., leading both civil and military agencies to step up funding for corporate partners.

“We kicked into high gear as soon as it was apparent a lot of companies were not going to be able to conduct business as usual due to distancing requirements,” Mike Read, International Space Station business and economic development manager at NASA’s Johnson Space Center, told CNBC.

U.S. equity investment in space companies totaled $5.4 billion across 36 deals in the first quarter, according to a report Friday by NYC-based firm Space Capital. But the second quarter is likely to just see a fraction of that investment, according to Space Capital managing partner Chad Anderson, as deal flow in the U.S. will follow China’s path. Chinese investment in space was climbing by record amounts until the first quarter, when “activity in China was basically shut off,” Anderson said

“For a lot of U.S. companies, when investors are retrenching, the government is stepping up and either increasing their investment or providing advances to some of these companies,” Anderson said. “Having the government as a lifeline is really important, particularly relevant for infrastructure companies that are launching satellites and hardware.”

There are several companies with projects on board the International Space Station, Read noted. Those NASA partners include companies such as Sierra Nevada Corp., NanoRacks, Made In Space, Teledyne Brown Engineering, Alpha Space and more. When the scope of the coronavirus crisis became apparent, Read said NASA began reaching out to each of the companies to understand their financial positions, as many are small businesses.

“As you can expect, for most it was not good. So we began looking at upcoming milestones on their contracts to see if we could split them, allowing for the immediate invoicing for work already completed towards the larger milestone. We were able to do that swiftly for many of our contracts,” Read said.

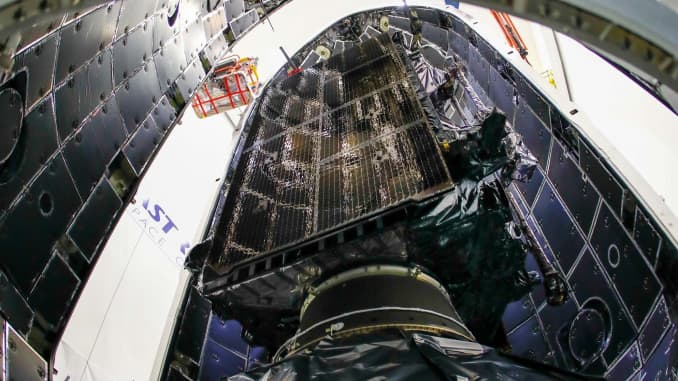

A look at the first Lockheed Martin-built GPS III satellite as it is put into the nosecone of a SpaceX Falcon 9 rocket.

As many space companies have significant national security contracts, divisions of the Department of Defense have also been stepping up funding and accelerating payments. Ellen Lord, under secretary of defense for acquisition and sustainment, noted in remarks earlier this week that the Pentagon expects “payments at the higher progress payment rate to start this week, helping provide $3 billion in increased cash flow to industry.” Lord emphasized that, among the Pentagon’s supply chain, companies building small rockets are among the most impacted by the crisis.

Brigadier General Steven Butow, the leader of the Defense Innovation Unit’s space portfolio, told CNBC in a statement that his unit is looking to help space companies survive the crisis.

“DIU is positioned to address new or expended prototype efforts involving commercial technology quickly, leveraging our Commercial Solutions Opening award process,” Butow said.

DARPA is similarly able to move up paying progress payments to its contractors, telling CNBC that its able to do so for up to 90% of costs for large businesses and up to 95% of costs for small businesses.

“As the pandemic progresses, we will continue to evaluate our entire research portfolio, determining where increased DARPA investments can be executed quickly to help the defense industrial base recover from COVID-19 impacts while accelerating our National Defense posture,” DARPA said in a statement.

The space industry’s resilience

Rocket Lab’s payload of 13 satellites for the Educational Launch of Nanosatellites 19 (ELaNa-19) mission for NASA.Rocket Lab

Space Capital expanded its quarterly report beyond space infrastructure companies, such as those building rockets or satellites. The report now includes investments in space-based distribution — such as Internet of Things device maker Skylo Technologies — and space-based applications — such as Indonesian ride-hailing and food delivery company Go-Jek.

The report found that $23.6 billion has been invested in space infrastructure in the past decade. But, combined with distribution and applications, Space Capital estimates that investment in space companies totals $109.2 billion since 2004, with 822 companies receiving investment from non-government sources.

“For the first time, we have a holistic picture of capital flows into the Space economy,” Anderson said in the report.

Credit: Space Capital

Anderson emphasized that Space Capital expects “the impact of the pandemic on private markets to be significant.” His view matches with a report by Quilty Analytics earlier this week, which estimated “that a bit less than half” of the top venture capital-backed space companies will survive the coming “COVID-19-induced recession.”

Space Capital’s report noted, however, that “the Space economy may fare somewhat better from a demand perspective than the economy-at-large.” Many space companies are business-to-business or business-to-government models, Anderson said, “which are historically more resilient than consumer-focused businesses.”

Anderson also highlighted that three types of satellite businesses are providing needed analysis to combat the coronavirus pandemic. “Geospatial intelligence” are companies that are monitoring the Earth through imagery, which helps analyze the macroeconomic effects of the virus. “GPS applications” track the movement of people, helping understand the potential reach of the virus. And “satellite communications” are helping people continue to work remotely, as well as connect remote doctors who are providing telemedicine.

“We expect these segments of the Space economy to adapt, and potentially even thrive, over the next year,” Anderson said.

Source