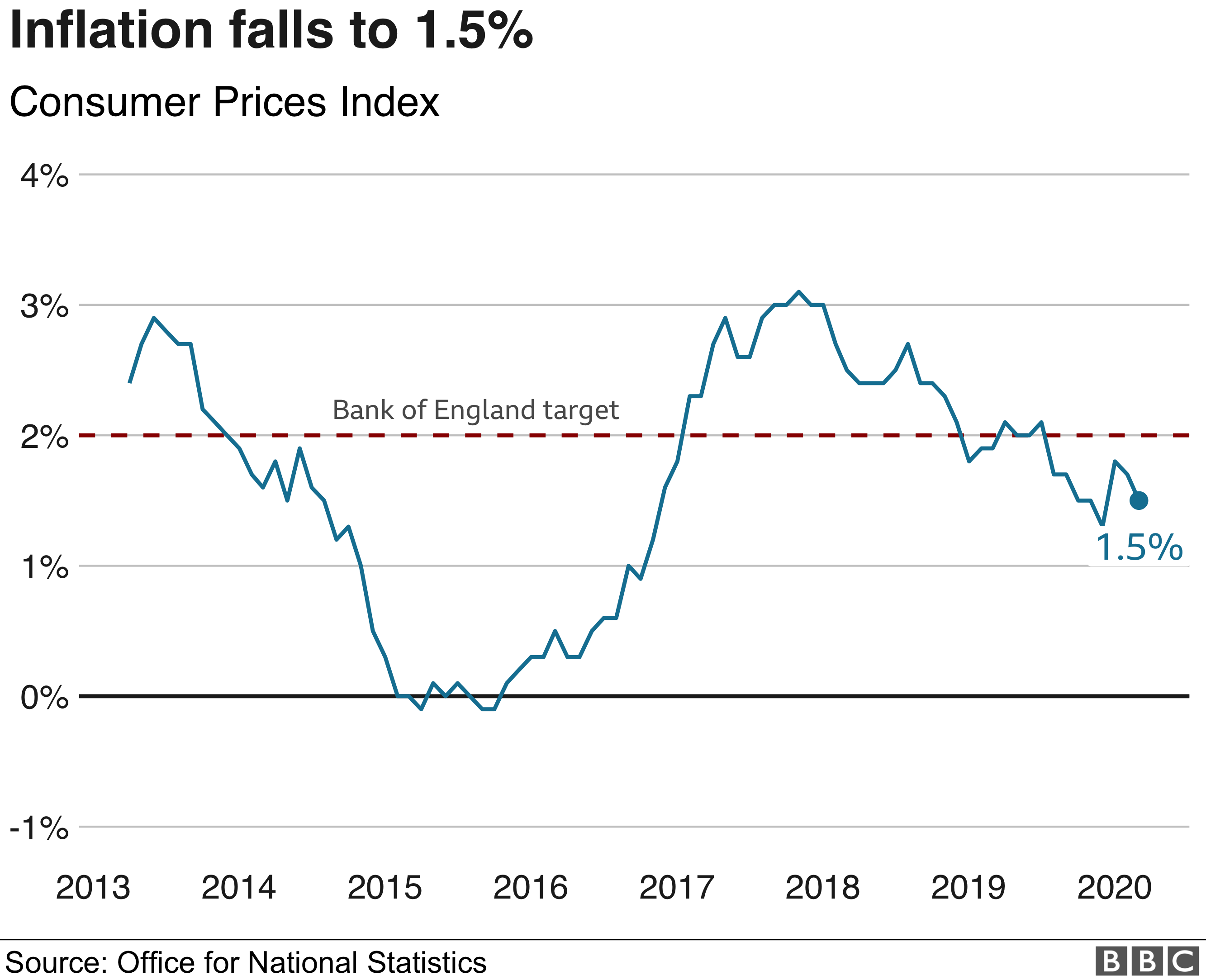

The UK’s inflation rate fell to 1.5% in March, largely driven by falls in the price of clothing and fuel ahead of the coronavirus lockdown.

The Consumer Prices Index (CPI) fell from 1.7% in February, according to the Office for National Statistics (ONS).

Clothing stores had offered more discounts as shoppers began staying at home, it said. Falling oil prices also resulted in cheaper petrol prices.

Economists warn inflation could slide to 0.5% in 2020 as the economy shrinks.

The ONS’s latest data was collected on 17 March, just before lockdown started on the 23rd. But its head of inflation, Mike Hardie, said there were already signs people were spending less in shops and more on necessities such as food.

The agency said prices of clothes and shoes had fallen by 1.2% in the year to March 2020.

It also said average petrol prices stood at 119.4 pence per litre during the month – the lowest seen since February 2019, while diesel stood at 123.8p

The UK benchmark for oil has fallen to about $16 (£13) a barrel as economic activity has slowed to trickle. That is a fall of about 75% since the start of the year.

Sarah Hewin, senior economist at Standard Chartered bank, told the BBC’s Today programme: “Normally low inflation would be welcomed as it means people have effectively more to spend in the shop but these are not normal circumstances.

“The fall in inflation, in addition to low energy prices, is an indication of the steep recession we will see in the coming months.”

What do I need to know about the coronavirus?

- A SIMPLE GUIDE: How do I protect myself?

- AVOIDING CONTACT: The rules on self-isolation and exercise

- HOPE AND LOSS: Your coronavirus stories

- LOOK-UP TOOL: Check cases in your area

- VIDEO: The 20-second hand wash

Meanwhile, Andrew Wishart at Capital Economics said: “We suspect a larger fall in CPI inflation, from 1.5% to 0.9% is in store for April as Ofgem [the regulator] lowers the cap on utility bills to reflect past falls in wholesale energy prices.”

He added that falling employment, consumer caution and falling energy prices would pull inflation “down to just 0.5% in the second half of this year”.

‘More help needed’

CPI remains below the Bank of England’s 2% target for inflation.

Inflation is one of the main factors that the Bank of England’s Monetary Policy Committee (MPC) considers when setting the “base rate”. That influences what interest rate banks can charge people to borrow money, or what they pay on their savings.

Last month it took the decision to cut interest rates in an emergency move as it tries to support the UK economy in the face of the coronavirus pandemic.

The UK’s central bank brought them down to 0.1% from 0.25%. Interest rates are now at the lowest ever in the Bank’s 325-year history.

The Bank said it would also increase its holdings of UK government and corporate bonds by £200bn in an effort to lower the cost of borrowing.

But Melissa Davies, chief economist at Redburn, said the Bank needs to go further: “It will be a volatile ride for inflation over the next year, with negative numbers a possibility followed by a sharp reversal.”

She added: “More stimulus is needed, with only limited quantitative easing help from the Bank of England and the Treasury’s lending guarantee scheme falling short. Even the furlough scheme is only delaying an inevitable and large spike in unemployment.”

For more News /

Source: https://www.bbc.com/news/business-52371062